Round Rock Chamber Stands Firm Against HB 134 – Protecting Our Economy and Future Growth

The Round Rock Chamber is taking a strong stand against House Bill 134, a proposed piece of legislation that would divert millions in local sales tax dollars from our city, threaten Round Rock’s ability to fund essential services, and unravel long-standing economic development agreements—including transformative partnerships like the one with Dell Technologies.

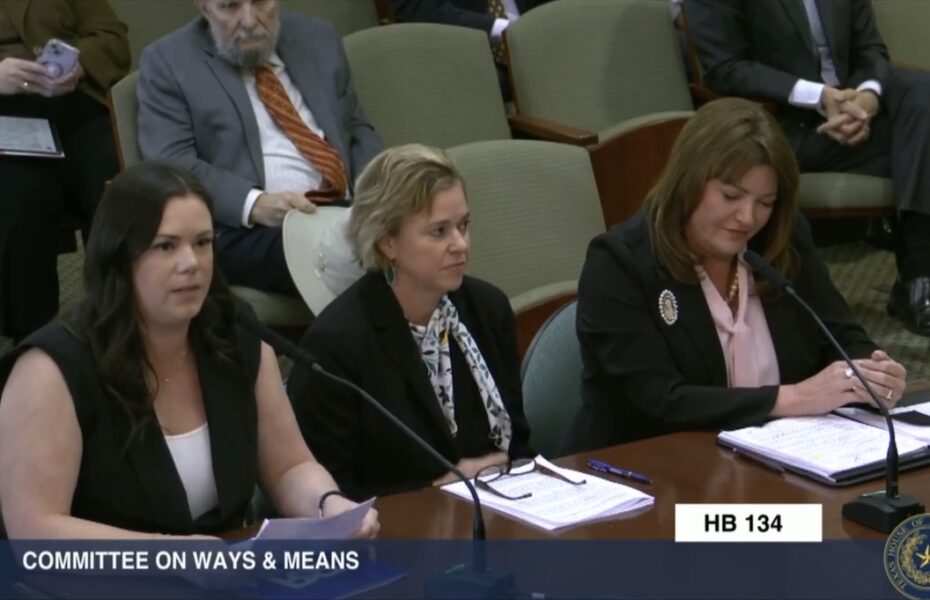

On March 17, 2025, Chamber President & CEO Jordan Robinson testified before the Texas House Ways & Means Committee in strong opposition to HB 134, which proposes shifting Texas’ sales tax system from an origin-based model to a destination-based model. If passed, this bill would have devastating consequences for cities across Texas—and Round Rock stands to be one of the hardest hit.

What’s at Stake for Round Rock?

- $30 Million in Lost Sales Tax Revenue – The City of Round Rock could lose up to $30 million annually in sales tax from Dell alone. These funds currently help pay for roads, public safety, utilities, and other essential city services that support both businesses and residents.

- Broken Economic Development Agreements – Round Rock’s Chapter 380 agreement with Dell, one of the longest-standing in the state, would be effectively nullified. Even if technically grandfathered, the city cannot rebate sales tax dollars it no longer collects, breaking trust and jeopardizing partnerships that have delivered thousands of high-paying jobs and more than $2 billion in state sales tax revenue.

- Weakened Business Recruitment and Growth – Sales tax revenues are also the backbone of our economic development programs, which communities like Round Rock use to attract new businesses, retain existing employers, and create quality jobs. If HB 134 passes, this proven and locally controlled tool would be severely weakened, leaving cities less competitive and more reliant on property taxes to fund growth.

- A Costly and Complex Burden for Small Businesses – HB 134 would create an accounting nightmare for small businesses, forcing them to keep track of more than 1,700 taxing jurisdictions across the state instead of the single sales tax rate where they are located. Businesses that sell goods or services online or operate outside their home community would now have to remit sales tax to each destination city—increasing compliance costs, confusion, and administrative burdens.

Now Is the Time to Act

Other states are adding new tools to strengthen their business climates—Texas should not be taking tools away. Our locally driven model is working. Just this month, Governor Abbott celebrated Texas’ 13th consecutive Governor’s Cup win for the most economic development projects in the country. Now is the time to build on that momentum, not dismantle the system that helped us get here.

Take Action Today

✅ Contact your local State Representatives and Senator – Let them know that HB 134 will harm our local economy and strip away the tools cities use to support smart growth.

📢 Make your voice heard by contacting members of the Senate Committee on Business and Commerce – Urge them to oppose HB 134 in the Senate and protect the ability of local communities to manage and fund economic growth.

HB 134 threatens the economic foundation that has made Round Rock a model for smart, sustainable development. If passed, we risk losing the very tools that helped transform our city and fuel decades of job creation, investment, and innovation.

View the full testimony here: https://app.uslege.ai/share/2c637132-9580-4cfa-aa34-c99327fa5638

Contact Us. We’re Here to Help.

Get in touch with our team to learn more about how the Round Rock Chamber can help.